The Rise, Fall, and Legacy of an American Building Supply Giant (1854-2004)

By Chuck Price | Wickes Lumber Alumni (1975-1994)

Quick Answer: What Happened to Wickes Lumber?

- Current Status: Defunct (liquidated September 2004)

- Originally Founded: 1854 as Wickes Bros. Iron Works (Saginaw, Michigan)

- Entered Lumber Retail: 1952 (Bay City Cash Way Company)

- Renamed Wickes Lumber Co.: 1962

- First Bankruptcy: April 1982 ($1.6 billion debt – successfully restructured)

- Emerged from Bankruptcy: 1985

- Spun Out as Independent Company: April 1988

- Second Bankruptcy: January 2004

- Final Liquidation: September 2004 (59 lumberyards sold to various buyers)

- Peak Operations: Approximately 100+ sales and distribution facilities across more than 20 states, supported by multiple manufacturing operations

- Commonly Cited Contributing Factors: Housing market softness, increased competition from national big-box retailers, legacy debt burdens, and leadership turnover

- UK Wickes Relationship: Established in 1972 as part of the broader Wickes organization; later operated under separate UK ownership and remains in business today

Wickes Lumber Company was a U.S.-based lumber and building materials distributor that operated nationally from 1952 until its liquidation in 2004, serving professional contractors, remodelers, and builders through wholesale distribution centers and manufacturing facilities.

Top Questions About Wickes Lumber (Quick Answers)

Is Wickes Lumber still in business?

No. The original U.S. Wickes Lumber/Wickes Inc. chain ended in liquidation in 2004.

When did Wickes Lumber close?

2004. The company filed Chapter 11 in January and completed liquidation later that year.

Is UK Wickes the same company as Wickes Lumber?

No. UK Wickes has operated independently since 1987 and is not affiliated with the former U.S. chain. See: Wickes (UK).

This timeline and history explain how Wickes evolved from an iron works into a national building materials supplier—and why it ultimately disappeared.

Wickes Lumber Timeline: 150 Years of History (1854-2004)

The timeline highlights the turning points that shaped Wickes: its industrial origins, the shift into lumber distribution, the leveraged expansion that led to the 1982 bankruptcy, and the competitive pressures that preceded the 2004 liquidation.

| Year | Event | Significance |

|---|---|---|

| 1854 | Wickes Bros. Iron Works founded in Flint, Michigan | Company origins in foundry/machine shop |

| 1864 | Relocated to Saginaw, renamed Wickes Bros. Iron Works | Strategic move to lumber industry hub |

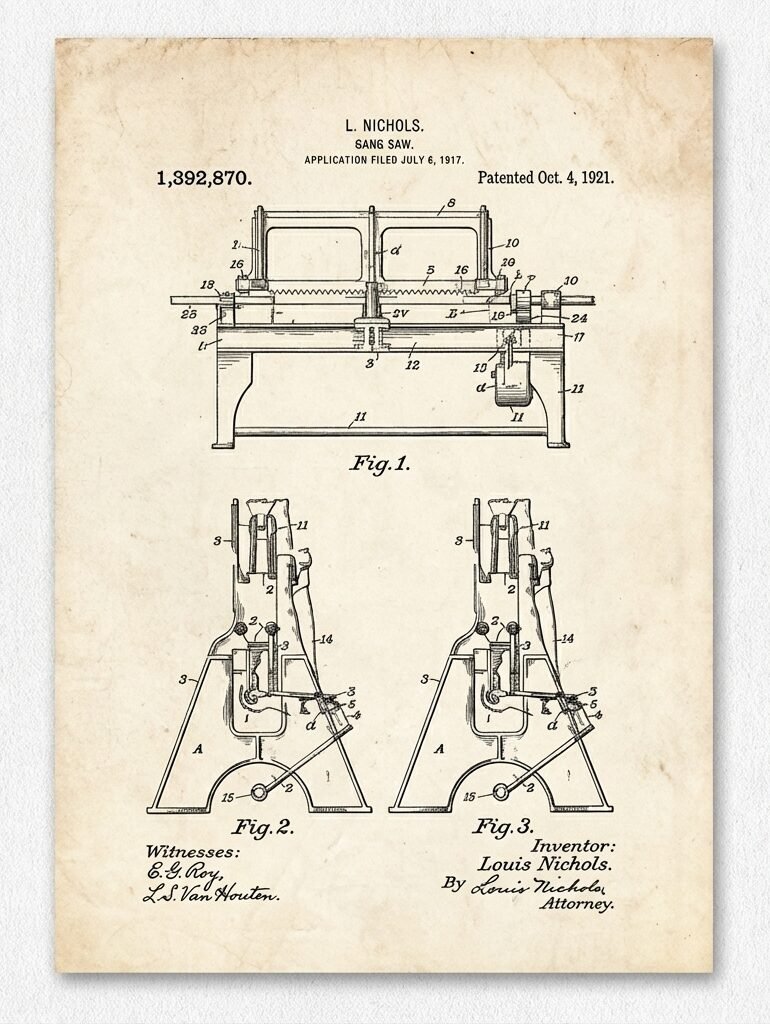

| 1869 | Gang saw innovation introduced | Revolutionary sawmill technology |

| 1887 | 300+ Wickes gang saws in operation | National market dominance |

| 1901 | Founders Henry and Edward Wickes die | Second generation takes control |

| 1947 | Three businesses merged to form Wickes Corp. | Consolidation of iron, boiler, graphite operations |

| 1952 | Bay City Cash Way Company launched | Entry into lumber retail |

| 1959 | Sold boiler business to Combustion Engineering | Focus shift to lumber operations |

| 1962 | Renamed Wickes Lumber Co. | Brand identity established |

| 1971 | Wickes Companies, Inc. formed as parent company | Corporate restructuring |

| 1978 | Acquired Builders Emporium chain | Home improvement expansion |

| 1980 | Acquired Gamble-Skogmo for $200+ million | Massive debt load assumed |

| April 1982 | Filed Chapter 11 bankruptcy ($1.6 billion debt) | Largest Chapter 11 since 1978 Bankruptcy Reform Act |

| 1985 | Emerged from bankruptcy | Successful turnaround under Sanford Sigoloff |

| 1988 | Wickes Lumber spun out as independent public company | Separation from parent conglomerate |

| 1997 | Renamed from Wickes Lumber Company to Wickes Inc. | Broader building materials focus |

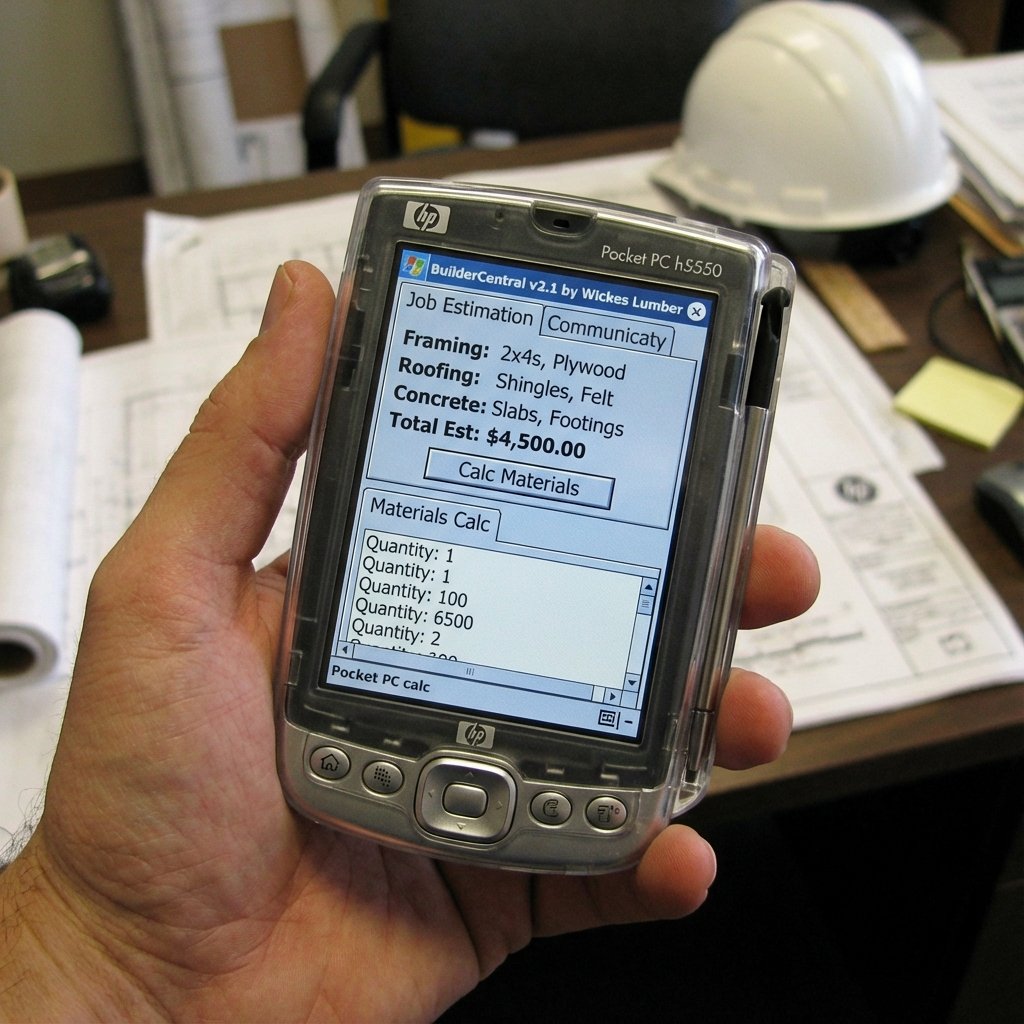

| Late 1990s | BuilderCentral software launched | Technology innovation for contractors |

| 2003 | Reported $45+ million net loss | Financial distress evident |

| January 2004 | Filed Chapter 11 bankruptcy (second time) | Recovery prospects were limited |

| September 2004 | Liquidated – 59 lumberyards sold to various buyers | End of national operations through liquidation sales |

The Wickes Brothers and the Birth of an Empire (1854-1952)

Brothers Henry Dunn Wickes and Edward Noyes Wickes founded Genesee Iron Works in Flint, Michigan in 1854, initially manufacturing equipment for the lumber industry before revolutionizing sawmill technology in 1869 with the oscillating gang saw. Their diversification strategy—adding boiler manufacturing and graphite production—ensured the company’s survival through Michigan’s lumber depletion and positioned it for eventual entry into retail lumber distribution in 1952.

From New York to Michigan’s Lumber Boom

The Wickes story begins not with lumber, but with iron. In 1854, brothers Henry Dunn Wickes and Edward Noyes Wickes left New York state for Flint, Michigan, drawn by opportunities in the burgeoning lumber industry. Michigan’s mid-19th-century lumber economy offered abundant pine resources and expanding industrial opportunity.

The brothers, along with partner H.W. Wood, established Genesee Iron Works—a foundry and machine shop specializing in repair work and manufacturing metal parts for logging equipment. The business model faced an inefficiency problem: pig iron had to be hauled from Saginaw, Michigan, while finished equipment was shipped back to Saginaw for distribution. The solution was obvious—move closer to the source.

In 1864, Wood sold his interest to the Wickes brothers (Saginaw’s swampland and mosquito-infested marshes didn’t appeal to him), and the company was renamed Wickes Bros. Iron Works. The relocation to Saginaw proved strategically sound, positioning the company at the heart of Michigan’s lumber boom.

The Gang Saw Revolution

The 1869 Wickes gang saw innovation introduced an oscillating frame mechanism that allowed multiple parallel saw blades to cut evenly through logs simultaneously, increasing milling speed while reducing waste through thinner-gauge steel blades. This breakthrough created national and international demand, with over 300 Wickes gang saws operating by 1887, establishing the technology as an industry standard that influenced sawmill design for generations.

The improved gang saw design helped Wickes become a recognized supplier to sawmills nationwide, even as regional timber resources shifted over time.

But the real breakthrough came in 1869. According to Encyclopedia.com’s corporate history, Wickes made fundamental improvements to the gang saw design that revolutionized lumber milling:

The new design gave an oscillating motion to the saw’s frame, allowing all the teeth of the machine’s parallel saw blades to cut evenly. The speed of the saw was increased and blades of a thinner-gauge steel were used to cut down on the amount of waste.

This innovation created a national—and eventually international—market for Wickes Bros. By 1887, more than 300 Wickes gang saws were in operation across the country. The technology allowed the company to survive even as Michigan’s lumber resources began depleting.

Diversification: Boilers, Graphite, and Survival

As Michigan’s timber economy matured, Wickes diversified beyond sawmill machinery into equipment resale, boilers, and graphite—lines that helped stabilize the company across cycles and regions.

Recognizing the finite nature of Michigan’s lumber supply, the Wickes brothers diversified aggressively. They began buying equipment from struggling sawmills, reconditioning it, and reselling it to mills in other regions. This repair and resale business expanded to include all types of industrial machinery.

Observing that industrial boilers were among the most frequently traded items, the brothers established the Wickes Boiler Company as a separate manufacturing operation. Henry’s sons, Harry and William, eventually took over management—Harry leading the foundry operations and William heading the boiler business.

Another diversification came from an unexpected discovery. During a visit to Mexico, the Wickes brothers found a large deposit of graphite and established the United States Graphite Company to exploit this resource.

By 1947, these three distinct businesses—iron works, boiler manufacturing, and graphite production—were merged to form Wickes Corp. Both founding brothers had died in 1901 (Edward first, followed just a month later by Henry), but their diversification strategy ensured the company’s survival into the mid-20th century.

The Boiler Business Exit

The boiler division, while profitable, came with significant liability risks. As FundingUniverse’s company history documents, the company upgraded its bent-tube boilers to handle 350,000 pounds of steam per hour, experiencing strong sales to factories, refineries, schools, hospitals, and utilities.

However, boiler failures occasionally occurred. In the late 1950s and early 1960s, a series of incidents involving higher-capacity units led to significant litigation exposure for the company. The company made a strategic decision: discontinue the boiler business and concentrate resources on the highly profitable lumber division.

In 1959, Wickes sold the boiler operation to Combustion Engineering Company. This decision marked a turning point—the company would focus on what would become its core identity: lumber and building materials.

Revolutionizing the Lumber Industry (1952-1980)

In 1952, Wickes launched the Bay City Cash Way Company with a revolutionary wholesale model—comprehensive lumber inventory at 16% margins versus the industry’s 50% standard—that attracted contractors frustrated by limited selection and high prices from traditional dealers. This success led to renaming the division Wickes Lumber Co. in 1962 and aggressive expansion that grew the company to 650+ locations worldwide with over $2 billion in annual sales by 1979.

The Bay City Cash Way Company: A New Model

Postwar housing demand exposed weaknesses in traditional lumber supply: limited selection, inconsistent availability, and high-margin pricing that caused delays and increased costs for contractors.

In 1952, Wickes saw an opportunity. Under the supervision of Joseph S. McMullin, the company took a portion of a former grain terminal in Bay City, Michigan, and opened a retail outlet for building supplies with a revolutionary concept: maintain comprehensive inventory of all lumber and construction products builders might need.

The Bay City Cash Way Company operated on razor-thin margins—as low as 16 percent compared to the industry standard of 50 percent or more. The model worked. Volume compensated for margin, and builders flocked to a supplier that offered both selection and value.

Explosive Growth and the Wickes Lumber Brand

The Bay City success led to additional outlets. In 1962, the business was officially renamed Wickes Lumber Co. The company’s growth strategy combined organic expansion with strategic acquisitions:

- 1955: Acquired Michigan Bean Company, one of the country’s largest bean storage facilities, in an all-stock transaction valued at $1.6 million (New York Times)

- 1960s-1970s: Expanded into retail furniture, consumer credit, modular housing, and commercial construction

- 1971: Formed Wickes Companies, Inc. as the parent company of Wickes Corp.

- 1978: Acquired Builders Emporium chain of retail home improvement stores

According to a 1979 industry publication celebrating the company’s 125th anniversary, Wickes classified itself as the world’s largest retailer of lumber and building supplies. The company had grown to include:

- Six lumber and building material divisions active in the West

- Operations spanning from California to the Northeast

- 45 lumber and building supply centers in Europe (Netherlands, West Germany, Belgium, and Great Britain)

- A building materials warehouse in Saudi Arabia

- Annual sales surpassing $2 billion

- 21 divisions and 17,000 employees in over 650 locations worldwide

The Gamble-Skogmo Acquisition: Growth Through Debt

In August 1980, Wickes made its most ambitious acquisition: purchasing Gamble-Skogmo Inc., a Minneapolis-based retail conglomerate, for more than $200 million. While this grew Wickes’ aggregate sales to more than $4 billion annually, it also loaded the company with significant new debt.

The acquisition included Tempo, a discount variety store chain. Less than a year later, in May 1981, Wickes shut down Tempo’s 29 stores in the Western United States—an early sign that the Gamble-Skogmo integration wasn’t proceeding as planned.

The company had grown rapidly through aggressive acquisition, but it had also taken on substantial leverage. When economic conditions shifted, that debt would become unsustainable.

The First Bankruptcy and Turnaround (1982-1985)

Wickes Companies filed for Chapter 11 bankruptcy in April 1982 with $1.6 billion in debt—the largest Chapter 11 reorganization since the 1978 Bankruptcy Reform Act. Turnaround specialist Sanford C. Sigoloff implemented aggressive restructuring including asset divestitures, operational streamlining, and debt negotiations that successfully brought the company out of bankruptcy in 1985, creating a textbook turnaround case studied in business schools.

The $1.6 Billion Collapse

In April 1982, Wickes Companies filed for Chapter 11 bankruptcy protection with approximately $1.6 billion in debt.

Wickes Bankruptcies Compared: 1982 vs. 2004

Wickes experienced two distinct bankruptcies separated by 22 years—the 1982 filing involved the parent conglomerate Wickes Companies with $1.6 billion debt that was successfully restructured under Sanford Sigoloff, while the 2004 filing involved the independent Wickes Inc. lumber company with 59 remaining stores that were liquidated rather than reorganized due to housing market decline and big-box competition.

| Aspect | First Bankruptcy (1982) | Second Bankruptcy (2004) |

|---|---|---|

| Filing Date | April 1982 | January 2004 |

| Company Name | Wickes Companies, Inc. (parent conglomerate) | Wickes Inc. (independent lumber company) |

| Debt Amount | $1.6 billion | $45+ million net loss (6 months prior) |

| CEO/Turnaround Specialist | Sanford C. Sigoloff (“Ming the Merciless”) | N/A (no turnaround specialist brought in) |

| Primary Causes | Gamble-Skogmo acquisition debt, retail underperformance, early 1980s recession | Housing market downturn, big-box competition, legacy debt, leadership instability |

| Store Count | 650+ locations (all divisions) | 59 lumberyards |

| Outcome | Emerged successfully in 1985 | Liquidated September 2004 |

| Historical Significance | Largest Chapter 11 since 1978 Bankruptcy Reform Act | End of 150-year corporate history |

| What Happened to Assets | Restructured, non-core divisions sold, lumber operations spun out (1988) | Lumberyards sold through liquidation sales to various buyers |

Primary Causes of the 1982 Bankruptcy

The bankruptcy wasn’t caused by a single factor but rather a combination of challenges:

- Excessive Debt Load: The Gamble-Skogmo acquisition and other leveraged purchases left Wickes vulnerable to economic downturns

- Retail Struggles: General retail operations (like Tempo) underperformed expectations

- Economic Recession: Early 1980s economic conditions hurt both housing and retail sectors

- Integration Problems: Difficulty managing diverse operations across multiple retail categories

The Turnaround Specialist: Sanford C. Sigoloff

Wickes brought in Sanford C. Sigoloff, a specialist in guiding and restructuring companies through bankruptcy proceedings. Sigoloff, who earned the nickname “Ming the Merciless” for his aggressive cost-cutting, implemented a comprehensive restructuring strategy:

- Asset Divestiture: Sold off or closed many general retail businesses and underperforming divisions

- Focus on Core: Concentrated resources on the profitable lumber and building materials operations

- Operational Efficiency: Streamlined operations and reduced overhead costs

- Debt Restructuring: Negotiated with creditors to restructure the massive debt load

The strategy worked. In 1985, after three years of restructuring, Wickes emerged from bankruptcy protection—a textbook turnaround that would be studied in business schools for years to come.

Post-Bankruptcy Acquisitions

Remarkably, shortly after emerging from bankruptcy in 1985, Wickes had the confidence (and credit) to make another significant acquisition. The company purchased the Gulf and Western Consumer and Industrial Products Group division from Gulf and Western Industries for approximately $1 billion.

This division included several subsidiaries:

- A.P.S.

- Bohn Aluminum and Brass Corporation

- H. Koch & Sons

- Kayser-Roth Corporation

- Simmons Company

- Unicord

Additionally, in May 1986, Wickes acquired Orchard Supply Hardware and Home Centers West from W.R. Grace, another conglomerate undergoing restructuring. These acquisitions demonstrated management’s belief that Wickes could succeed as a diversified company—if better managed than before.

Wickes Lumber Company as an Independent Entity (1988–2004)

The 1988 spin-out created a stand-alone Wickes focused exclusively on lumber and building materials distribution. While the separation simplified the corporate structure, the newly independent company faced increasing pressure from changing market conditions and intensifying competition.

The Spin-Out and Operational Scope

In April 1988, Wickes completed a strategic spin-out in which Wickes Lumber Company became an independent public company, separating the lumber business from the former parent conglomerate’s diversified holdings.

At its post–spin-out peak, Wickes Lumber operated a broad, multi-state network that included:

- Roughly 90–110 sales and distribution facilities across more than twenty U.S. states, primarily in the Midwest, Northeast, and South

- Component manufacturing operations producing pre-hung doors, roof and floor trusses, and framed wall panels

- A customer base centered on professional contractors and remodelers, with limited exposure to retail DIY consumers

- Occasional exploration of international activity as part of broader expansion initiatives

In June 1997, the company changed its corporate name from Wickes Lumber Company to Wickes Inc., reflecting an expanded building materials identity rather than a change in core operations.

The Riverside Group Era (1991–2003)

In 1991, J. Steven Wilson assumed the roles of Chairman and Chief Executive Officer of Wickes Lumber while simultaneously serving as Chairman and CEO of Riverside Group Inc., a Jacksonville-based holding company that became the majority shareholder. This governance structure, while disclosed and lawful, placed executive leadership of both the investor and the operating company under a single individual.

In 1996, Riverside increased its ownership position through a reported $10 million investment, bringing its stake to approximately 55 percent. Contemporary announcements described the investment as an effort to strengthen Wickes’ balance sheet and support ongoing restructuring initiatives. Despite these measures, the company continued to report recurring operating losses during the 1990s.

In April 2003, Riverside sold its controlling interest to Imagine Investments, and Wilson resigned from his leadership roles. Wickes Inc. filed for Chapter 11 bankruptcy protection in January 2004. Public records document a sequence of prolonged financial challenges, a change in control, and a subsequent bankruptcy filing.

Innovation: BuilderCentral Technology

BuilderCentral was Wickes Lumber’s contractor-focused estimation and materials-planning software, designed to help users calculate project costs, determine material quantities, and streamline ordering workflows. Contemporary descriptions presented it as part of Wickes’ effort to support contractors with software tools during a period when on-site and handheld computing was still emerging.

It was marketed as a practical tool for contractors to estimate jobs and translate plans into accurate materials orders.

According to a trade-oriented description, BuilderCentral helped users:

- Estimate project costs accurately

- Determine materials needed and quantities

- Boost profits, especially for small businesses

- Streamline the estimation and ordering process

The initial challenge was accessibility—as a computer program, BuilderCentral was difficult to access from job sites. The company worked to develop versions that could be used on portable devices, making the software more accessible for on-site use. This reflected an early effort to integrate software into contractor workflows before mobile apps became commonplace.

Warning Signs and Leadership Changes

By the early 2000s, several pressures converged and reduced Wickes’ ability to stabilize operations:

Commonly Cited Contributing Factors in Wickes’ 2004 Outcome

| Factor | Impact on Business | Severity |

|---|---|---|

| Housing Market Slowdown | New construction began losing momentum, reducing contractor demand for building materials | Critical |

| Big-Box Competition | Home Depot and Lowe’s aggressively expanded into contractor markets, contributing to margin pressure | Critical |

| Legacy Debt | Financial burdens from previous restructurings limited operational flexibility and investment capacity | High |

| Leadership Instability | Leadership turnover contributed to strategic inconsistency and loss of institutional knowledge | Moderate |

| Asset Overextension | Expanded during boom times but couldn’t scale back quickly enough when market contracted | Moderate |

In its last published financial statements before bankruptcy, Wickes Inc. reported a net loss of over $45 million for the six months leading up to June 2003. The independent lumber company that had emerged from the parent company’s restructuring was now facing its own financial crisis.

Store Count and Geographic Footprint

At different points in its history as an independent company, Wickes Lumber operated varying numbers of locations:

- Late 1990s peak: roughly 90–110 sales/distribution locations

- Early 2000s: roughly 100–120 locations (varied by year and reporting)

- At the 2004 bankruptcy/liquidation period: roughly 50–60 remaining lumberyards

The declining location count tells the story of a company gradually contracting, selling assets, and trying to find a sustainable operating model in a changing market.

The 2004 Liquidation and Aftermath

Wickes Inc. filed for Chapter 11 bankruptcy in January 2004 and, unlike the 1982 restructuring, proceeded directly to liquidation rather than reorganization. By September 2004, the company’s remaining lumberyards were sold through a liquidation process to various buyers, ending the Wickes Lumber brand’s 52-year presence as a national building materials chain.

Chapter 11 Filing and Final Closure

In January 2004, Wickes Inc. filed for Chapter 11 bankruptcy protection for the second time in the company’s history. Unlike the 1982 bankruptcy, this time there would be no dramatic turnaround.

The company attempted to reorganize and emerge as a viable business, but market conditions and competitive pressures made recovery increasingly difficult. By September 2004, the company’s remaining lumberyards were sold to various buyers through a liquidation process, ending the Wickes Lumber brand’s 52-year presence as a national building materials chain.

Asset Dispersal to Multiple Buyers

The company’s locations were sold to various building materials distributors and regional operators. Some buyers absorbed former Wickes locations and continued to serve contractors and builders in those markets—though without the Wickes brand.

The liquidation affected thousands of employees. Unlike large-scale retail bankruptcies where stores close suddenly, the lumberyard sales meant some continuity for certain locations—but under new ownership and often with significant staff reductions. Communities that had relied on Wickes Lumber as a major employer and supplier faced the challenge of transitioning to new suppliers or traveling to more distant locations.

What Happened to Wickes Locations?

After liquidation, individual sites had different outcomes depending on buyer interest and local market conditions:

- Acquired by Regional Operators: Continued operating under new ownership or later merged into other building supply chains

- Independent Acquisitions: Some locations were purchased by local or regional lumber companies

- Closures: Underperforming locations were simply shut down

- Repurposed Properties: Real estate was sold for other commercial uses

Today, if you search for “Wickes Lumber” and find operational locations, they’re typically independent companies using the name—not remnants of the original chain.

Wickes Legacy: Innovation and Industry Impact

Wickes Lumber’s legacy includes three major innovations that permanently influenced the construction industry: the 1869 gang saw design that revolutionized lumber milling efficiency and became an industry standard, the wholesale distribution model introduced in 1952 that established high-volume low-margin building materials supply as a viable business strategy, and BuilderCentral software that pioneered mobile construction estimation technology more than a decade before smartphones.

The Gang Saw Revolution’s Lasting Influence

The 1869 gang saw design—featuring the oscillating frame that allowed parallel blades to cut evenly—became an industry standard that influenced sawmill design for generations.

Modern sawmill technology still incorporates principles from the Wickes gang saw innovation: parallel blade configurations, waste reduction through thinner blades, and increased cutting speed. The Wickes brothers’ contribution to lumber milling efficiency helped make large-scale wood construction economically viable in late 19th and early 20th century America.

Wholesale Distribution Model

Wickes Lumber’s pioneering of the wholesale lumber distribution model addressed key inefficiencies. Before the 1952 Bay City Cash Way Company, builders faced:

- Limited selection from small, independent dealers

- High prices due to low volume and high margins

- Frequent stockouts causing construction delays

- Inefficient procurement requiring multiple suppliers

Wickes Lumber’s approach—comprehensive inventory, low margins, high volume—became the template for modern building supply distribution. Today’s contractor-focused lumberyards and building material distributors operate on principles Wickes helped establish.

Technology Leadership

BuilderCentral represented an early recognition that construction technology extended beyond tools and materials to include software and digital solutions. By developing portable versions for early handheld devices, Wickes anticipated the mobile computing revolution in construction by more than a decade.

Modern construction estimation software, mobile apps for contractors, and integrated supply chain systems all descend from pioneering efforts like BuilderCentral.

The UK Wickes: A Separate Success Story

UK Wickes followed a separate corporate path and is not affiliated with the former U.S. Wickes Lumber chain.

One common source of confusion: the relationship between U.S. Wickes Lumber and UK Wickes stores. According to Wickes UK’s history, in 1972, the United States-based Wickes Companies (parent of Wickes Lumber) teamed with British builders’ merchants Sankey’s to open the first Wickes store in the United Kingdom.

This became a separate entity that followed its own trajectory:

- 1987: Floated on the London Stock Exchange with 41 locations

- 1996: Accounting irregularities discovered; management shakeup

- 2000: Purchased by Focus Group

- 2005: Sold to Travis Perkins

- 2021: Demerged from Travis Perkins, re-listed on London Stock Exchange

- Today: Operates as Wickes Group plc, Britain’s second-largest home improvement retailer

Over time, UK Wickes operated under separate ownership and management from the U.S. Wickes Lumber business. When Wickes Inc. liquidated in 2004, UK Wickes continued operating and remains successful today with hundreds of locations across Britain.

Modern Companies Using the Wickes Name

If you search for “Wickes Lumber” today and find operational businesses, you’re likely encountering one of several scenarios:

- Independent Companies: Building supply businesses using “Wickes Lumber” as a trade name, unrelated to the historical chain

- Former Locations: Businesses operating from former Wickes sites but under new ownership

- Regional Operations: Small lumber companies that may have purchased naming rights or simply adopted the name

None of these represent a continuation of the original Wickes Lumber Company that filed for bankruptcy in 2004. The brand, while still recognized in some markets, no longer represents a national chain with centralized ownership.

Frequently Asked Questions About Wickes Lumber (Extended)

What caused Wickes Lumber to fail?

Wickes’ 2004 outcome is generally attributed to a mix of softer housing demand, intensifying big-box competition, limited flexibility from prior financial burdens, and leadership turnover—factors that compounded rather than acting independently.

Unlike the company’s first bankruptcy in 1982 (which was overcome through restructuring), the 2004 filing occurred in a more competitive environment that made recovery less likely.

Where can I find former Wickes Lumber locations?

Former Wickes Lumber locations now operate under various names depending on who purchased them:

- Acquired by Building Materials Distributors: Many locations were purchased and integrated into regional building materials distribution networks (later acquired by other companies)

- Regional Lumber Companies: Independent acquisitions by local or regional building supply businesses

- Repurposed Properties: Some sites no longer operate as lumberyards

The best approach is to search for building material suppliers in your specific area rather than looking for Wickes Lumber specifically.

How many bankruptcies did Wickes go through?

Two major bankruptcies:

- April 1982: Wickes Companies filed for Chapter 11 with $1.6 billion in debt (largest Chapter 11 since the 1978 Bankruptcy Reform Act); emerged successfully in 1985

- January 2004: Wickes Inc. (the spun-out lumber division) filed for Chapter 11; liquidated by September 2004

The parent company also transformed into Collins & Aikman, which filed for bankruptcy in 2005 and dissolved in 2007—but this was a separate corporate entity by that time.

What innovations did Wickes Lumber pioneer?

Wickes contributed several significant innovations to the construction and lumber industries:

- Gang Saw (1869): Oscillating frame design that revolutionized lumber milling efficiency

- Wholesale Distribution Model (1952): High-volume, low-margin approach to building materials distribution

- BuilderCentral Software (1990s): Early construction estimation and materials calculation software, later adapted for mobile devices

- Integrated Manufacturing: Operating component manufacturing plants alongside distribution centers to produce pre-hung doors, trusses, and wall panels

Conclusion: Lessons from 150 Years

The Wickes Lumber story spans 150 years of American industrial and commercial history—from a small iron foundry in 1854 Michigan to a nationwide building materials empire, through two bankruptcies, and ultimately to liquidation in 2004.

Wickes’ story shows how operational innovation can coexist with financial and strategic risk—and how competitive shifts can overwhelm legacy distribution models that once dominated their category.

Yet Wickes also exemplifies the dangers of overleveraging, the challenges of managing rapid expansion, and the difficulty of adapting to changing competitive landscapes. The company that emerged from its first bankruptcy in 1985 couldn’t overcome the structural challenges of the early 2000s—big-box competition, housing market slowdowns, and shifting customer preferences.

For those who worked at Wickes Lumber, the company represented more than corporate history—it was a workplace, a community, and a significant part of American construction industry infrastructure. The closure meant job losses, community disruption, and the end of relationships built over decades.

Today, while the Wickes Lumber name occasionally appears on independent lumberyards, the national chain is gone. But its influence persists in how building materials are distributed, how contractors estimate jobs, and how the lumber industry evolved throughout the 20th century.

Understanding Wickes Lumber’s rise and fall provides valuable context for anyone researching construction industry history, studying corporate restructuring, or simply trying to understand what happened to a once-dominant name in American retail.

About the Author: Chuck Price worked at Wickes Lumber from 1975 to 1994, experiencing firsthand the company’s expansion period, first bankruptcy and restructuring, and the early years of the independent Wickes Lumber Company.

Last Updated: December 2025